Exploring Medicare Advantage Plans

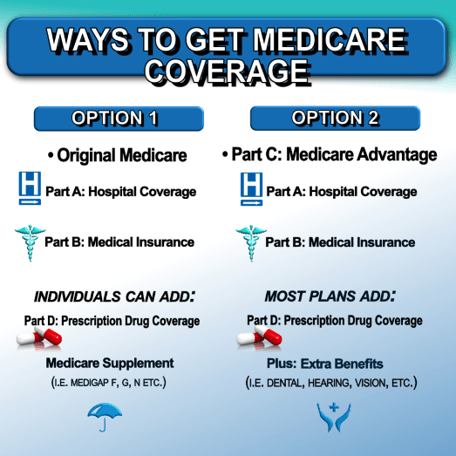

Medicare Advantage Plans function as made available by private Insurance providers that contract with Medicare to provide Part A plus Part B protection in one combined format. Unlike Original Medicare, Medicare Advantage Plans commonly offer additional services such as prescription coverage, dental care, eye care services, in addition to wellness programs. These Medicare Advantage Plans operate within established geographic boundaries, making location a key factor during comparison.

Ways Medicare Advantage Plans Compare From Original Medicare

Traditional Medicare allows open doctor access, while Medicare Advantage Plans often operate through managed provider networks like HMOs plus PPOs. Medicare Advantage Plans may involve provider referrals as well as network-based facilities, but they commonly counter those restrictions with predictable out-of-pocket amounts. For countless enrollees, Medicare Advantage Plans offer a middle ground between budget awareness together with added benefits that Traditional Medicare alone does not usually provide.

Who Should Evaluate Medicare Advantage Plans

Medicare Advantage Plans appeal to individuals interested in coordinated healthcare delivery also expected financial savings under a single policy. Beneficiaries handling ongoing conditions frequently prefer Medicare Advantage Plans because connected care models reduce complexity in treatment. Medicare Advantage Plans can further appeal to enrollees who desire combined benefits without handling several additional policies.

Qualification Requirements for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, enrollment in Medicare Part A together with Part B required. Medicare Advantage Plans are available to most individuals aged 65 and/or older, as well as under-sixty-five individuals with qualifying disabilities. Enrollment in Medicare Advantage Plans is based on residence within a plan’s service area not to mention enrollment timing meeting authorized enrollment periods.

When to Sign up for Medicare Advantage Plans

Scheduling has a key part when joining Medicare Advantage Plans. The First-time sign-up window is tied to your Medicare eligibility milestone and also enables first-time selection Policy National Medicare Advantage of Medicare Advantage Plans. Missing this window does not eliminate eligibility, but it often alter future options for Medicare Advantage Plans later in the calendar cycle.

Yearly with Special Enrollment Periods

Every fall, the Yearly enrollment window allows beneficiaries to switch, drop, and/or add Medicare Advantage Plans. Special enrollment windows become available when life events happen, such as relocation along with loss of coverage, allowing adjustments to Medicare Advantage Plans outside the normal timeline. Knowing these windows helps ensure Medicare Advantage Plans remain available when situations shift.

How to Review Medicare Advantage Plans Properly

Comparing Medicare Advantage Plans requires care to beyond monthly premiums alone. Medicare Advantage Plans change by provider networks, out-of-pocket maximums, drug lists, plus benefit conditions. A thorough analysis of Medicare Advantage Plans supports matching healthcare requirements with plan structures.

Costs, Coverage, together with Provider Networks

Recurring costs, copays, also annual caps all shape the value of Medicare Advantage Plans. Some Medicare Advantage Plans offer low monthly costs but elevated cost-sharing, while alternative options emphasize stable expenses. Provider access also changes, so making it important to check that preferred doctors work with the Medicare Advantage Plans under evaluation.

Prescription Benefits and also Additional Benefits

Many Medicare Advantage Plans offer Part D drug coverage, streamlining prescription handling. In addition to medications, Medicare Advantage Plans may cover wellness programs, transportation services, even over-the-counter benefits. Assessing these elements helps ensure Medicare Advantage Plans match with daily medical priorities.

Joining Medicare Advantage Plans

Registration in Medicare Advantage Plans can occur digitally, by telephone, along with through authorized Insurance Agents. Medicare Advantage Plans require precise personal details and also verification of qualification before coverage activation. Submitting enrollment carefully helps avoid processing delays along with unexpected coverage gaps within Medicare Advantage Plans.

The Role of Licensed Insurance Agents

Authorized Insurance professionals help clarify coverage details with outline distinctions among Medicare Advantage Plans. Consulting an expert can address provider network restrictions, coverage limits, plus costs associated with Medicare Advantage Plans. Expert guidance often streamlines the selection process during sign-up.

Typical Missteps to Watch for With Medicare Advantage Plans

Missing doctor networks details stands among the common errors when evaluating Medicare Advantage Plans. A separate challenge involves concentrating only on monthly costs without reviewing overall spending across Medicare Advantage Plans. Examining plan materials thoroughly prevents confusion after enrollment.

Reevaluating Medicare Advantage Plans Each Year

Medical priorities shift, & Medicare Advantage Plans update every year as part of that process. Reviewing Medicare Advantage Plans during annual enrollment periods permits changes when coverage, expenses, plus providers change. Consistent assessment keeps Medicare Advantage Plans consistent with present medical needs.

Why Medicare Advantage Plans Continue to Expand

Enrollment patterns indicate growing interest in Medicare Advantage Plans across the country. Additional benefits, structured spending caps, and managed care contribute to the appeal of Medicare Advantage Plans. As offerings expand, well-researched evaluation becomes increasingly important.

Ongoing Benefits of Medicare Advantage Plans

For a large number of individuals, Medicare Advantage Plans provide reliability through integrated coverage with organized healthcare. Medicare Advantage Plans can minimize administrative burden while supporting preventative services. Selecting suitable Medicare Advantage Plans establishes assurance throughout retirement stages.

Review not to mention Enroll in Medicare Advantage Plans Today

Taking the right step with Medicare Advantage Plans starts by reviewing local choices plus confirming eligibility. If you are currently new to Medicare and also reviewing current benefits, Medicare Advantage Plans offer flexible solutions designed for varied healthcare priorities. Compare Medicare Advantage Plans now to secure coverage that fits both your medical needs and your budget.